mn irs collections phone number

The Minnesota Department of Revenue collects tax debts and debts owed to other government agencies in Minnesota. Refund status 800-829-4477.

See How Each State Taxes Retirees In Our State By State Guide To Taxes On Retirees Social Security Benefits Social Security Social

East - Suite 700 Bloomington MN - 651 312-8082.

. Refund status and 1099G lookup. Customer service 800-829-1040. Paul area call the Taxpayer Advocate.

If you are concerned about a potentially fraudulent contact from MN Revenue please contact. 651-539-1599 Guidance to All Licensed Collection Agencies and Registered Collectors Related to Coronavirus Enforcement Guidance regarding Minnesota Statutes 33233 subd. Targeted GroupEconomically Disadvantaged Small Business Program.

Local time Alaska Hawaii follow Pacific Time. For assistance in Spanish call 800. IRS Phone Number For Individuals Who Claim Identity Theft.

The Minnesota Department of Revenue asks you to supply this information on the contact form to verify your identity. We may attempt to reach you by. To contact the IRS call.

Monday through Friday from 700 am. Message get attention NO. What is the phone number of this Internal Revenue Service office in Rochester.

Form 433-B Collection Information Statement for Businesses PDF. An authorized MN Revenue staff will be able. Forms and publications 800-829-3676.

See reviews photos directions phone numbers and more for Minnesota Department. Minneapolis Minnesota IRS Office Contact Information. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF.

IRS Hours of Telephone Service. This number is valid from 7 am to 10 pm. IRS Collections Department Phone Number 800-829-3903 - Info Statistics.

The main IRS phone number is 800-829-1040 but this list of other IRS numbers could help. No IRS Letter or Consequences Encountered. The best times to call during April are.

As we collect these debts the law. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters. Which is the IRS.

Click for Directions on Google Maps. 7 rows If you are in the MinneapolisSt. The information requested on the contact form is personal information that.

Lost IRS check 800-829-1954. Address and Phone Number for Minneapolis Minnesota IRS Office an IRS Office at South Marquette Avenue Minneapolis MN. The Minnesota Department of Revenue temporarily stops collection action on tax debts owed by active-duty military personnel National Guardsmen or reservists and their spouses upon.

The Minnesota Department of Revenue is responsible for collecting taxes and other state debt. If you do not pay what you owe we may take action against you. You may apply for a Minnesota Tax ID number with the Minnesota Department of Revenue online at Business Registration by phone at 651-282-5225 or 800-657-3605 or by filing a paper form.

Minnesota County and Municipal Ordinances. Authorizes us to use various tools. Minnesota Statutes Session Laws and Rules.

First St Duluth MN - 218 626-1624. The customer service telephone number is 507-281-3044 and ZIP code is MN 55904. Phone number to dial 800-829-3903.

Daycare Business Income And Expense Sheet To File Your Daycare Business Taxes Page 2 Taxtime Incom Starting A Daycare Daycare Business Plan Childcare Business

Free Rv Checklist Printable Packing List Dont Et Anything On Your Next Camping Trip In Your Travel Trailer Thi In 2020 Rv Checklist Printable Packing List Packing List

Vintage Print Book Booklet Irs 1977 1976 Instructions For Form 1040a Income Tax Print Book Booklet Instruction

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

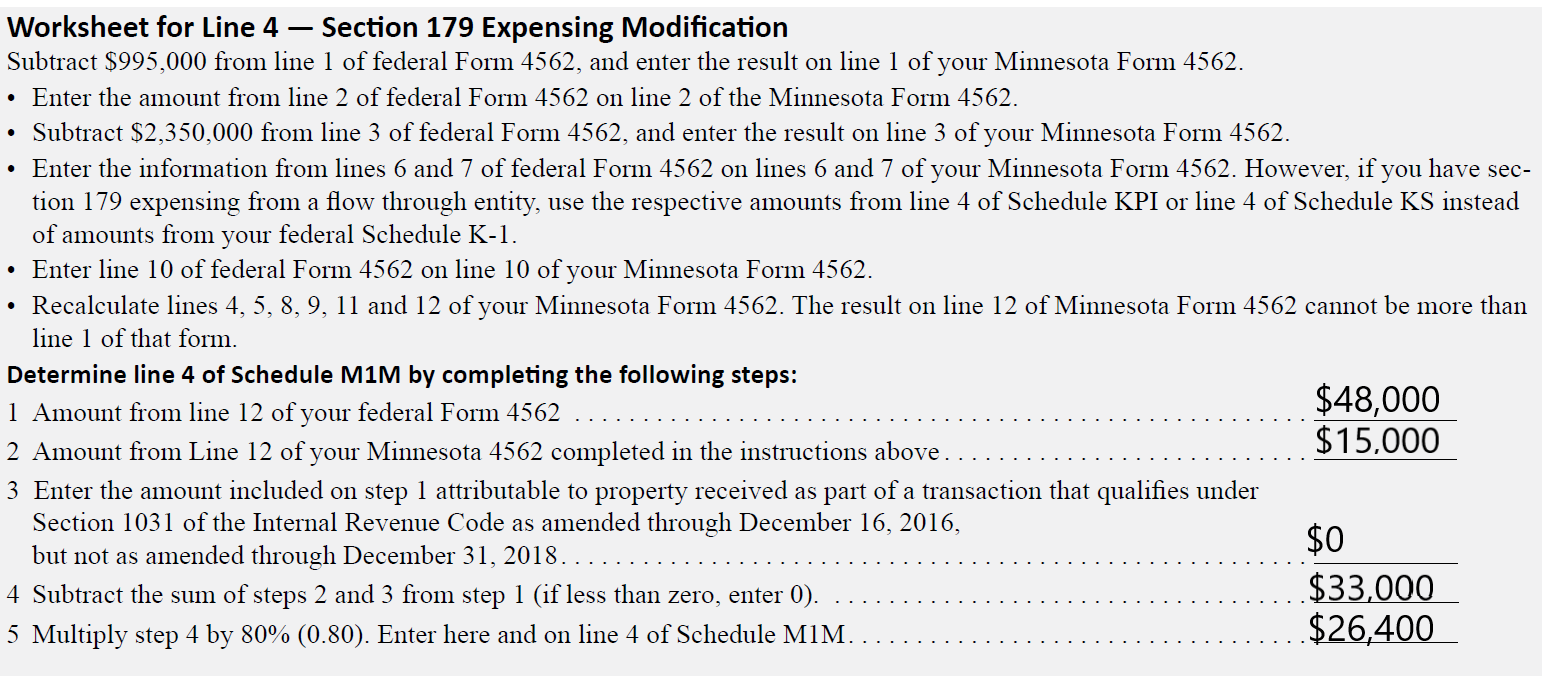

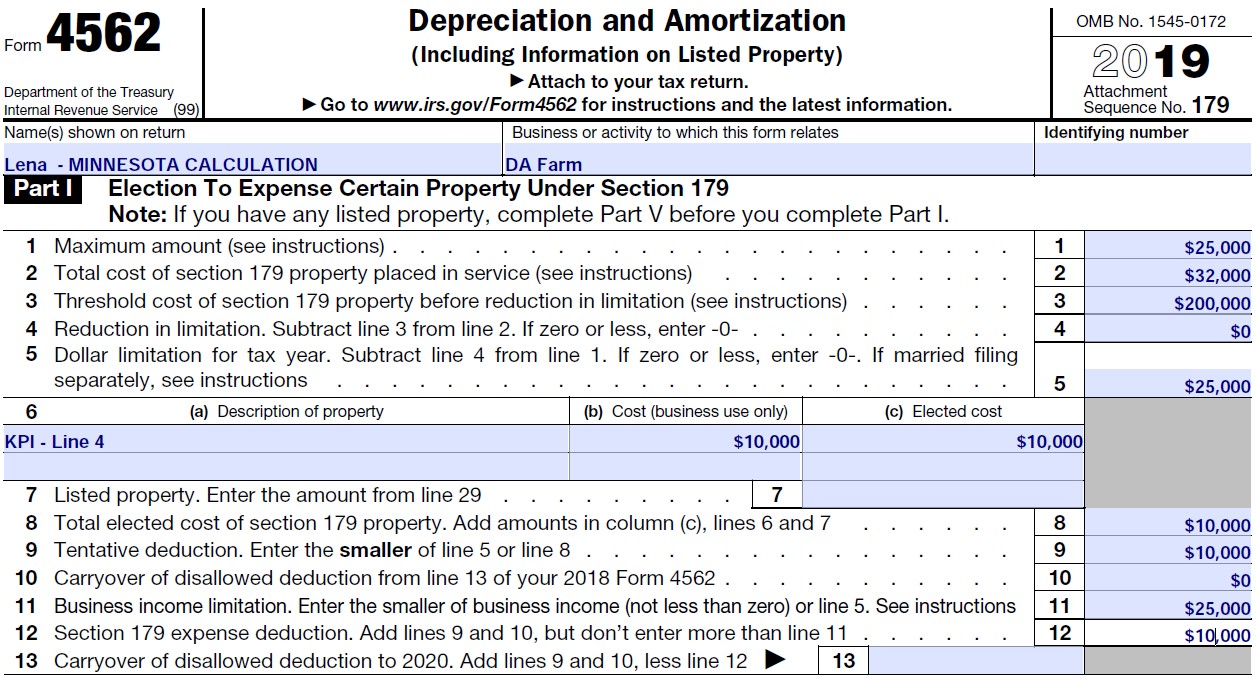

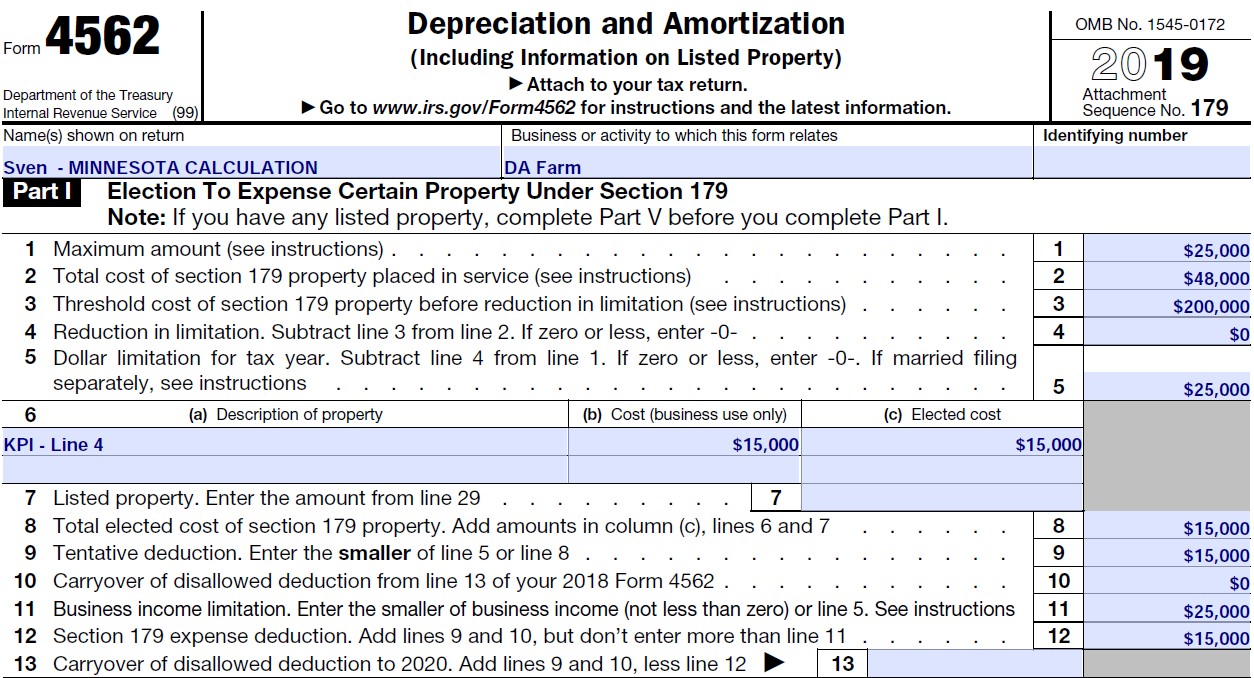

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Minnesota Public Records Searches Online Public Records Records Search Online Taxes

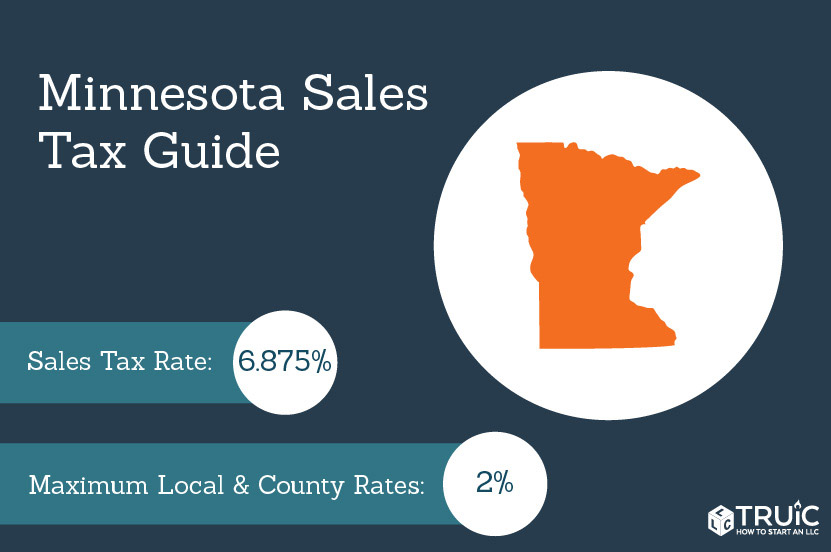

Minnesota Sales Tax Small Business Guide Truic

Dave Ramsey Allocated Spending Plan Worksheet Financial Peace Dave Ramsey How To Plan

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Minnesota Last Will And Testament Form Last Will And Testament Will And Testament Business Letter Template

State By State Guide To Taxes On Retirees Retirement Retirement Income Retirement Planning

How Businesses Can Use Blockchain To Boost Revenue Agira Blockchain Business Boosting

Section 179 Addback Example 2 Partnership Flow Through Minnesota Department Of Revenue

Fill Free Fillable Minnesota Department Of Revenue Pdf Forms

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Minnesota Department Of Revenue Minneapolis Mn Mm Financial Consulting Minneapolis Lettering Letter I